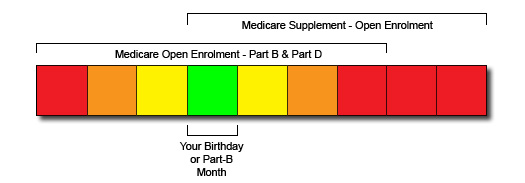

There are three key events that are the most important with regard to Medicare, Medicare Supplement Insurance and Prescription Plans:

- Turning 65

- Adding Medicare Part B

- Loosing Employer Group Insurance

If #1 or #2 is going to occur for you the next three months, or if they have occurred within the last five (5) months. OR If #3 is going to occur in the next three months or has occurred in the last 63 days, then you need to contact us immediately. You do not want to miss this one-time window.

The graphic above is somewhat simplified, because there are several variables. If you are turning 65 and/or expect to add Medicare Part B in the next three month (or either of these events has occured in the last five months), then I highly recommend that you contact us immediately, so that we can make sure you do not miss any opportunities to save money.

The Ideal Timeline

- Three months prior to your 65th birthday, contact Social Security and sign up for Medicare Part B (Doctor and Outpatient Coverage). The number for Social Security is: 1-800-772-1213. You also visit your local Social Security office. Click the logo to locate the closest Social Security Office to you.

- Contact Southern Senior Care to go over your options for a Medicare Supplement and a Part-D Drug Plan. Don’t wait until you get your Medicare card to contact us. We can do all of the paperwork and have everything coincide with your Medicare start date.

- Even if you already have Medicare Parts A and B and a Supplement, you should still contact us. If you are within your six (6) month Medigap open enrollment, you can change to a better Supplement Plan without any health questions and you are guaranteed to be accepted.

What if you missed your Open Enrollment Period?

If you are beyond your Open Enrollment period, you should still contact Southern Senior Care. There is an excellent chance that we can still help you save a significant amount of money on your Medicare Insurance.

Since we are licensed with so many Medicare Supplement companies, we can match your personal health with the company that provides the best rates. Some of the biggest Medicare Supplement companies do not offer any discounts at all. It is common for our clients to save $400-$600 per year on their Medicare Supplement insurance.

Some plans offer various discounts that can add up to hundreds, even thousands of dollars per year for the EXACT same Medicare Supplement Plans. What does Medicare say about this?

{ 0 comments… add one now }